Portfolios

Global-Macro Multi-Factor Portfolios

A lot goes into building your multi-factor portfolios. First there are multiple research partners analyzing and crunching tons of data. Portfolio construction is a data driven process that is mathematically derived.

Global Macro Risk Management

The research partners have found two factors to be most consequential for forecasting future financial market returns: economic growth and inflation. They track both on a year-over-year rate of change basis (i.e. 2nd derivative) to better understand the big picture then ask the fundamental question: Are growth and inflation heating up or cooling down? Data is analyzed for the U.S. and the top 50 economies around the world covering 90% of global GDP to produce growth and inflation forecasts for each. Rate of change – things occurring on the margin can provide great insight to the directions of economies and markets.

Based on this data we determine what factors we want to emphasize in the portfolios and what factors we want to limit in the portfolios with the purpose of lowering risk. All portfolios will maintain diversification based on the risk tolerance of the model. This is positioning, not trading.

Multi-Factor Positioning

Example of Relative Cycle Positioning

Rate of change – things occurring on the margin can provide great insight to the directions of economies and markets.

Your Portfolio

We all are trying to grow our assets for use in the future even if income is needed currently from our portfolio. Balancing or aligning your comfort level of risk in your portfolio with the growth objectives is critical to long-term success. You set the parameters for your portfolio. All the work still goes into building each portfolio based on the global-macro, multi-factor process. (Click here for Pdf)

Portfolio Risk Score Ranges

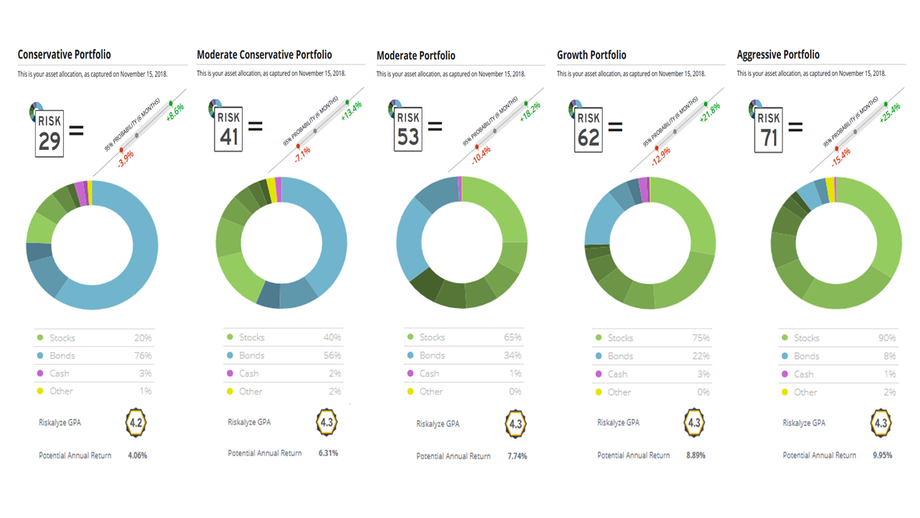

Portfolios cover a 10 point risk score range. Your personal risk score is viewed as your maximum risk level. Based on research and data, risk may be reduced below your stated level but will not go above. Risk management is a cornerstone of the global-marco multi-factor portfolios.

- Conservative Portfolio - Risk Score 30 (Range 25 to 35)

- Moderate Conservative Portfolio - Risk Score 40 (Range 35 to 45)

- Moderate Portfolio - Risk Score 50 (Range 45 to 55) (Click for sample portfolio)

- Growth Portfolio - Risk Score 60 (Range 55 to 65)

- Aggressive Portfolio - Risk Score 70 (Range 65 to 75)

Get Started

If you would like to have a conversation about your situation and determine if this approach is right for you please use the contact tab for contact information. If you are ready to get started now, begin by completing Your Risk Number.